Complex investments require powerful tools. With streamlined modeling, forecasting, and analysis, piiPacer gives advisors the power to make more informed private capital allocation decisions, optimize allocation strategies, and model the timing of cash flows and commitments with confidence.

Please provide a few details in order for our team to connect with you.

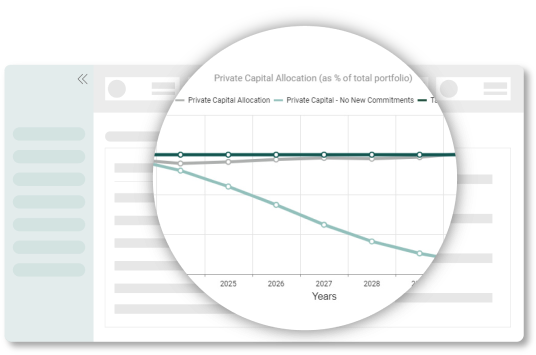

Plot forecasted performance against desired commitment levels to instantly recognize whether portfolios will meet their targets, and adjust accordingly.

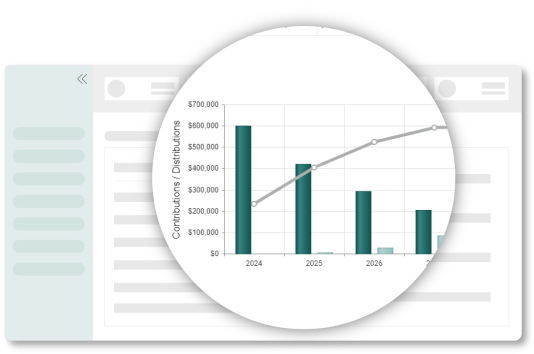

When it comes to capital investments, timing is everything. piiPacer lets your team quickly see the schedule of contributions and distributions, to make more informed decisions, and set the right expectations.

piiPacer gives your team the flexibility to easily run, test, and compare multiple variables across any combination of strategies, to identify the optimal allocation to achieve your goals.

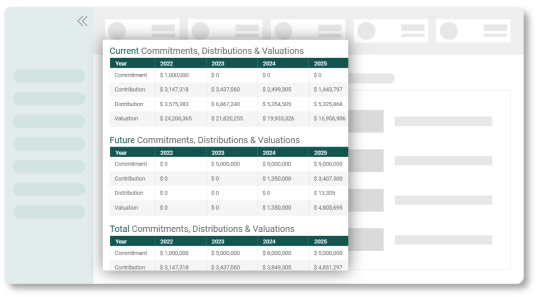

Aggregate data across clients, or focus in on each model — then view the details behind it with the ability to zoom in on individual investment forecasts.

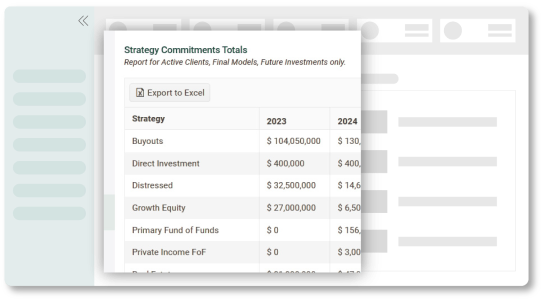

Quickly create easy-to-read reports to view your forecasted commitments by client or aggregated by strategy.

Protect the integrity of every model and avoid consequential mistakes. piiPacer’s workflows allow for all new models, and updates to existing models, to be reviewed and approved before they are put into action with user-based read, write, and approval permissions at the fund or account level.